Fix and flip insurance should protect your rehab budget, your timeline, and your lender’s requirements. Therefore, this guide shows the seven mistakes that cause denied claims, surprise costs, and delays. Specifically, vacancy rules, renovation work, theft, and renewals create the biggest gaps.

Consequently, one burst pipe during demo can drain your budget fast. Furthermore, a copper theft or a jobsite injury can stall the project. In contrast, the right policy keeps your deal moving and your cash protected.

Moreover, investors usually do not get burned because they skipped insurance. Instead, they get burned because the policy is missing key parts.

Let’s fix that.

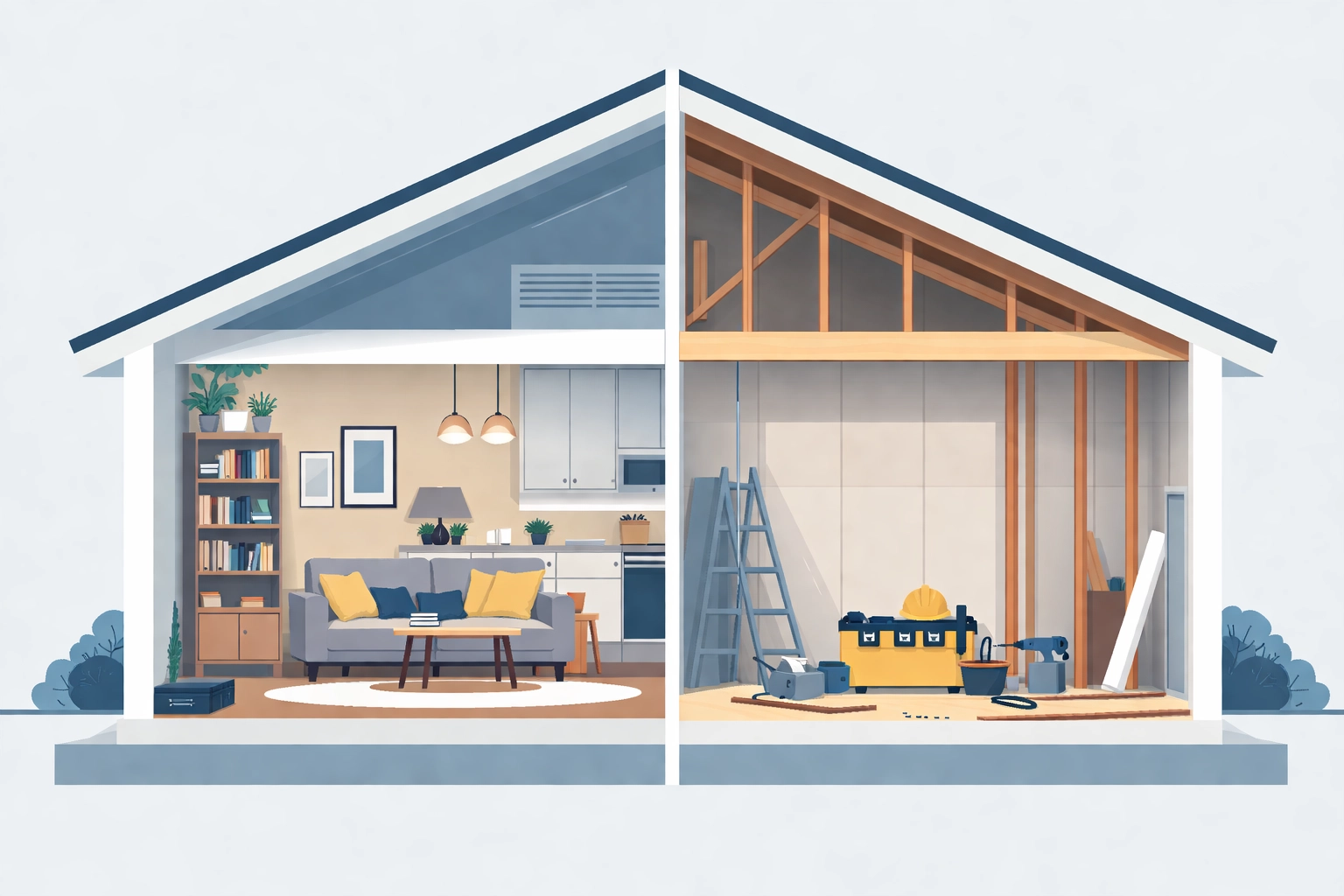

This is the big one. You cannot insure an investment property: especially one under renovation: with a standard homeowners policy. Full stop.

A homeowners policy assumes someone lives in the property. When the carrier finds out your "home" is actually a vacant rehab project with demo crews coming and going, they'll deny your claim faster than you can say "policy exclusion."

Fix and flip insurance exists specifically for properties that are:

Consequently, if you're still trying to save a few hundred bucks by listing the wrong occupancy status, you're gambling your entire investment on a minor rule. Moreover, insurance companies love minor rules.

The fix: Be upfront about occupancy status from day one. Work with an agent who specializes in insurance for real estate investors: they'll get you the right policy structure without the guesswork.

Here's a scenario we see constantly: An investor buys fix and flip insurance, feels covered, then discovers their policy excludes damage that occurs while the property sits vacant.

Most standard policies have vacancy clauses that kick in after 30-60 days of the property being unoccupied. Consequently, once that clock runs out, claims for vandalism and water damage can be denied. Furthermore, some carriers can deny certain fire claims too.

Renovation timelines slip. Permits get delayed. Contractors ghost you for two weeks. Before you know it, your property has been "vacant" long enough to void your coverage.

The fix: Make sure your policy includes a vacant property endorsement or is specifically designed for properties that won't be occupied during the renovation phase. This is non-negotiable for REI insurance.

Dwelling coverage protects the structure as it exists today. But what about the $40,000 in improvements you're about to pour into it?

Builder's risk insurance covers the increased value of your property during construction. Specifically, it can cover materials, fixtures, and labor already invested. Without it, a fire or major storm can wipe out months of work, and you may only recover the pre-renovation value.

One investor we spoke with lost $30,000 on a single water damage claim because their policy didn't account for the renovation work in progress. The structure was covered. The new HVAC system, electrical panel, and kitchen cabinets? Not so much.

The fix: Add builder's risk coverage that scales with your renovation budget. Make sure it covers materials both on-site and in transit: because theft happens at the supply house parking lot too.

If you're using hard money or private financing (and most flippers are), your lender will require proof of insurance before releasing funds. This isn't optional.

Wait until the last minute to secure coverage, and you risk:

Lenders want to see themselves listed as the loss payee. They want liability minimums met. And they want documentation before wire day: not after.

The fix: Start your insurance conversation the moment you go under contract. At RealAssure, we're known for fast, clear communication specifically because we understand that deals move quickly and investors can't afford to wait around for quotes.

"Full coverage" is a marketing term, not a policy term. Every insurance policy has exclusions: and if you don't read them, you'll find out the hard way.

Common exclusions in fix and flip insurance include:

That beautiful waterfront flip in a flood zone? Your standard policy won't touch water damage from rising tides or storm surge. The foundation crack caused by your contractor's sketchy excavation work? Also excluded.

The fix: Read your policy's exclusion section. Actually read it. Then ask your agent specifically about the risks your property faces: flood zones, earthquake-prone areas, older construction with known issues. Layer additional coverage where needed.

Construction sites are theft magnets. Copper wire, HVAC units, appliances, power tools: anything that isn't bolted down (and sometimes things that are) can disappear overnight.

A single theft can blow your renovation budget and push your timeline back weeks. Without coverage for materials and equipment, every dollar of replacement cost comes straight out of your profit.

Here's what proper fix and flip insurance should cover:

The fix: Verify that your policy includes theft coverage for materials at every stage: not just after installation. And consider additional security measures (cameras, motion lights, secured storage) that may lower your premiums.

Renovation timelines are optimistic by nature. That "90-day flip" becomes 120 days. Then 150. Suddenly your annual policy is up for renewal while you're still finishing punch list items.

Gaps in coverage: even short ones: can be terrible. Therefore, if something happens during a lapse, you're completely exposed. Moreover, if your lender finds out, they may call your loan or force-place expensive coverage on your behalf.

The fix: Set calendar reminders 60 days before your policy expires. Build insurance renewal costs into your project budget from the start. If your flip is running long, communicate with your carrier early to extend coverage seamlessly.

Fix and flip insurance isn't about checking a box for your lender. It's about protecting months of work, tens of thousands of dollars in capital, and your ability to do the next deal. Furthermore, it helps you avoid delays that kill your timeline.

The seven mistakes above aren't theoretical. They're the exact gaps that cause real investors to lose real money every single day.

Here's a quick checklist before your next project:

At RealAssure, we work exclusively with real estate investors who need coverage that actually fits how they operate. No generic policies. No guesswork. Just clear answers and fast turnaround so you can close deals and move on to the next one.

Ready to make sure your next flip is properly protected? Get a quote and let's talk through exactly what your project needs.